The retail market in Warsaw has undergone a transformation, particularly over the last decade. First and second generation shopping centres, located in densely populated residential areas, mainly in the outskirts of the city, comprised of a hypermarket anchor e.g. Centrum Handlowe Targówek, Centrum Handlowe Reduta, Centrum Janki, Centrum Ursynów, Auchan. Exceptions include Promenada and Blue City which are supermarket-anchored. Third generation retail centres such as Galeria Mokotów (20002002), Arkadia (2004) and Złote Tarasy (2007) included a leisure element from the beginning of their operations.

The retail market situation in Warsaw is very unique. From mid-1990s to 2007, there have always been construction works on new large-scale retail centres in Warsaw. The last proper shopping and leisure centre was, however, Złote Tarasy opened in 2007, whilst overall the most recent addition to retail stock in Warsaw was Galeria Rembielińska in autumn 2008 as part of a residential block.

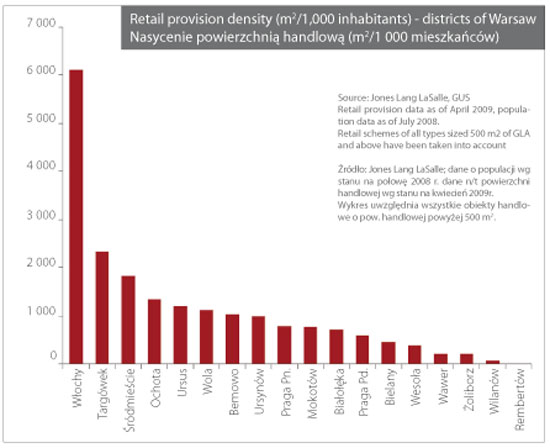

At present, retail construction activity in Warsaw is extremely limited (gallery adjacent to E.Leclerc in Ursynów, department store by Wolf on ul. Bracka and Metropol Dom i Wnętrze). The reason underlying this situation is, however, not due to market saturation. The retail density in Warsaw is still relatively low (496 m2/1,000 inhabitants) in comparison with other major Polish agglomerations. It must be remembered that the density is based upon the official population figures and would be significantly lower if unofficial population size is used in the calculations. However, differences still exist between the districts of Warsaw as pictured on the graph below. It is worth pointing out that the significant retail clusters in Janki, Marki and Piaseczno have been included in the density of Włochy, Targówek and Ursynów respectively, influencing the final ranking. The reason behind this concept is that, despite out-of-town location, these clusters have a significant impact upon the retail potential in the adjacent districts and as such cannot be ignored. Therefore, Włochy is a frontrunner in respect of the retail density in Warsaw, due to the inclusion of the Centrum Okęcie (Real, Media Markt, Meble Agata, Praktiker), and the huge retail cluster in Janki with Centrum Janki (Real, Leroy Merlin, Saturn, Cinema City) and Park Handlowy Janki (Ikea, Praktiker, Electro World). Targówek, ranked second, includes the cluster of retail development in Marki i.e. M1 centre with Real and Praktiker; Centrum Handlowe Targówek; Zielony Park Handlowy; Park Handlowy Targówek with Ikea, Domoteka, Leroy Merlin, Electro World, Decathlon and others. Interestingly, Ursynów ranks relatively low (in the middle of the

ranking) despite the inclusion of Auchan and Fashion House in Piaseczno.

Spending power in Warsaw

An important measure of affluence in a given area is the overall purchasing power. It is defined as the total value of goods and services that the population in a given area can afford to buy over a year. Unsurprisingly Warsaw residents have higher purchasing power in comparison to the entire country. On the average, they can nominally purchase almost 64% more goods and services than an average inhabitant of Poland, the best score amongst all 2,478 municipalities in Poland. However, the discrepancies in spending power between the districts are in some cases 100%. An in-depth analysis demonstrates that the majority of affluent population is concentrated in the south-western and northern parts of Warsaw. Ursynów, Wilanów Czerniaków, Natolin, Żerań Zachodni, Tarchomin, Pyry and Powsin are frontrunners in this respect. These areas feature the highest overall purchasing power per capita.

From the point of view of a retail developer, the attractiveness of a given area is determined not only by high purchasing power per capita but also the overall volume of cash concentrated in that area.

A simple rule applies here - the more people live in the area, the larger pool of money. Thus most desired retail locations should feature a combination of a large pool of money with a high purchasing power per capita. Having regard to the two parameters as above, Ursynów and Natolin are ranked high in Warsaw as the two areas are characterized by top rankings of both parameters. The leader group also encompasses Tarchomin, Służew, Czerniaków, Wierzbno, Sielce, Mokotów Stary, Szosa Krakowska, Górce, Bemowo Zachód – all these areas have a high purchasing power, coupled with a relatively large pool of money. In addition, taking one of the two aspects into account, the following areas should also be regarded attractive for retail development: Bródno (large pool of money) and Wilanów, Powsin, Żerań Zachodni and Pyry (top purchasing power per capita). In conclusion, the capital city is diverse with regards to purchasing power of Warsaw residents. This should be taken into account when looking for sites for new retail projects.

Future residential development in Warsaw

A key part of a retail analysis is the site catchment area. While status quo analyses are quite easily feasible based on available demographic data, prognoses are not. In order to estimate the future population living in a defined catchment area, it is critical to monitor the development of the residential market on a regular basis. This applies both for the secondary market and the primary market. In case of the former, transformations in the population pattern of a functioning neighbourhood are mainly due to gradual changes in household structures. Current trend in this respect is a development towards less dense living, with the number of persons within a household gradually declining. Thus, changes in the secondary market typically point towards a decrease in residents lining in the existing housing stock. On the contrary, Warsaw’s primary market is quickly developing and adds a large portion of new dwellers to certain neighbourhoods. The increase in population is derived from both migrants and the inner-city redistribution of Warsaw residents. In any case, new residential development plans are a barometer of future growth areas in terms of population.

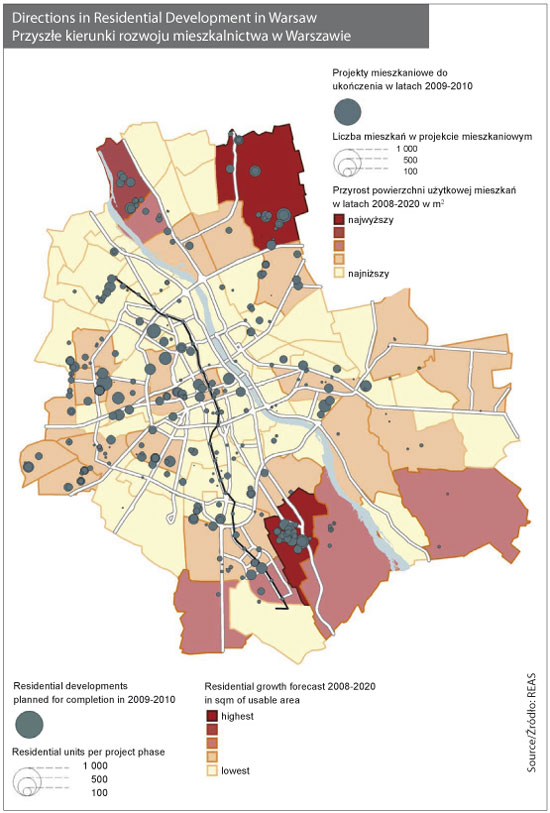

According to REAS monitoring of developers’ plans, there are more than 38,600 apartments planned to be completed in over 300 residential developments over 2009-2010. A large part of these projects is at advanced building stage, under construction or just before construction starts. Thus, the current crisis, which heavily impacts on Warsaw’s housing market in general, should bring limited changes to the progress of the majority of these projects. Nevertheless, it is inevitable that the completion of several developments will be postponed until after 2010 or, in a certain number of cases, brought to standstill, depending on the developer’s financial situation and the advancement stage of each specific project.

By far the largest concentration of residential developments to be completed during the next 24 months can be found in the Miasteczko Wilanów development area in the northern part of the Wilanów district. Another important region with high building intensities is the Białołęka district, particularly the three neighbourhoods of Mańki-Brzeziny, Nowodwory and Tarchomin. Furthermore, there are several smaller neighbourhoods of quite high construction and pipeline activity, such as Bemowo’s Górce area or the downtown neighbourhood of Centrum-Północ. These areas look set to change not only the physical/ architectural appearance but also the resident profile, both in quantitative and qualitative terms.

In addition to short-term outlook based on developers’ plans, REAS forecast residential growth in Warsaw’s 92 urban planning areas by 2020. This long-term forecast is chiefly built upon residential development opportunities according to official spatial planning documents from the Warsaw Municipality. Furthermore, it also takes into account development trends as well as developers’ announcements of projects for completion after 2010.

Again, REAS estimates show the highest long-term development potential in the urban areas of Wilanów-Czerniaków and Mańki-Brzeziny followed by two other Białołęka areas (Nowodwory and Tarchomin) as well as Ursynów’s Kabaty neighbourhood and a few peripheral areas in the southern parts of Warsaw. Since this forecast determines potential housing expansion in usable area, it does not translate into household or resident estimates, as single-family developments are included too. However, it gives a general idea of future development trends and, more importantly, it is able to confirm the key growth areas out of the short-term analysis for 2009-2010.

Conclusion - development opportunities

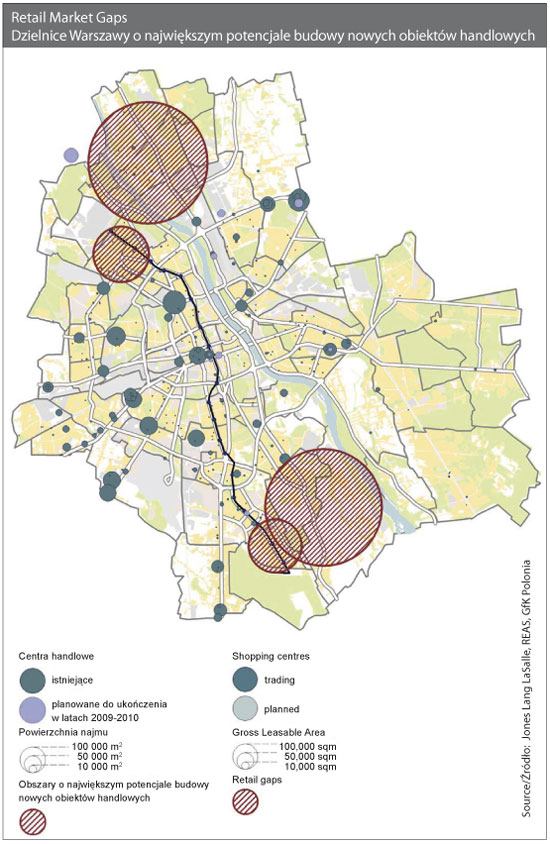

When the three aspects are taken into account, a clear picture of market opportunities emerges. Unsurprisingly, there are two regions in Warsaw featuring considerable development opportunities. These include:

Białołęka, most notably densely populated Tarchomin and Nowodwory.

This region meets the three criteria under consideration and is clearly underdeveloped in retail terms. The closest bigger retail centre is the Auchan hypermarket with an adjacent Leroy Merlin DIY store on Modlińska street in some distance to high-rise housing estates of Tarchomin and Nowodwory. We trust this has potential to support a hypermarket-anchored shopping centre with ‘life style’ retail facilities for young and reasonably affluent catchment population. In addition, this region will gain additional access and connectivity with the left bank of Wisła river upon the completion of the Northern Bridge.

Wilanów area towards the neighbouring Powsin region is one of the fastest growing residential hubs in Warsaw with high purchasing power. In addition, the retail development does not catch up with the amount of new residential units being delivered to the market. We think that a proper shopping centre is sustainable in this area, drawing from a wider catchment of Konstancin Jeziorna and Powsin.

In addition to the above, further two Warsaw areas rank high and we advocate including them in the considerations. These are:

Ursynów / Kabaty whose spending power coupled with residential development prospects justify further retail development of ‘life style’ category, catering for the needs of young catchment population. This is despite some retail facilities are already represented here e.g. Centrum Ursynów (Real, OBI), Auchan centre in Piaseczno, E.Leclerc and Tesco in addition to other retail centres. A retail development in this part of Warsaw should, however, have regard to that in the Wilanów region. Although we believe that there is a minor psychological barrier in travelling for shopping from Ursynów / Kabaty to Wilanów, the increased connectivity between Wilanów and Kabaty/ Ursynów following the extension of Płaskowickiej street should make it possible.

Bielany district in the northern part of Warsaw clearly features a lack of modern retail facilities whilst having an average spending power and reasonably strong residential growth forecasts. It might be arguable that this area is captured by the regional Arkadia shopping centre, however, we are convinced that increased connectivity of Bielany through the underground line and Northern Bridge (to be completed by 2012), coupled with growing residential estates are likely to positively impact retail development potential here. Again, we recommend to have regard to a potential centre which might be developed in Białołęka, particularly if a site in a vicinity of the Northern Bridge is selected.

By identifying the areas as above, we are not questioning sustainability of retail development in other parts of the city. On the contrary, we are convinced that there are likely to be some development activities elsewhere in Warsaw, particularly in the following retail categories:

Retail parks - due to lower development costs, short and simple construction process and therefore lower rental levels this concept is likely to become increasingly popular among occupiers. Retail warehouse parks are flexible structures and can be developed in a proximity to existing well performing shopping centres as extensions to their offer e.g. Zielony retail park Targówek or Młyn retail park in Wrocław.

Factory Outlet Centres – in a mid-to-long run, we identify a place for a maximum of two retail centres of this type still to be developed in the capital city.

Small convenience type formats with a supermarket or a discount store anchor and a service gallery targeting the primary needs of immediate catchment area population. Recent examples include Galeria Rembielińska, Berensona and Treny centres by MarcPol launched in Białołęka and Łomianki respectively.

Final remark

Following a period of unprecedented rises in land value and rental levels, coupled with development of increasing number of projects in increasingly smaller towns, the market clearly slowed down. Banks and financing institutions have started to take an extremely cautious approach towards new developments, with the current requirement for a minimum of 50% but most often 60%-70% pre-let before making a financing commitment. Given the recent weakening of retailer demand, this threshold is difficult to achieve at the early stage of the project.

Therefore a proper selection of retail site and concept is of critical importance at present. It must be remembered that the planning process typically takes 2-4 years from identifying a potential site until the commencement of construction works, depending upon the size of the project, its complexity and location. In addition, only 20% of Warsaw area has valid master plans, and large retail development is subject to stringent regulations. For these reasons, we recommend undertaking initial planning stage and site selection now in order to commence the leasing and construction when the market is expected to recover.

This innovative report has been created as a joint initiative of three high-profile consultants in the real estate field: Jones Lang LaSalle - leader on the commercial real estate market, GfK Polonia research institute and REAS residential advisors.

Source: Property Jornal Polska Giełda Nieruchomości 08-09/09

Biura WGN

Biura WGN CENTRALA WGN

CENTRALA WGN